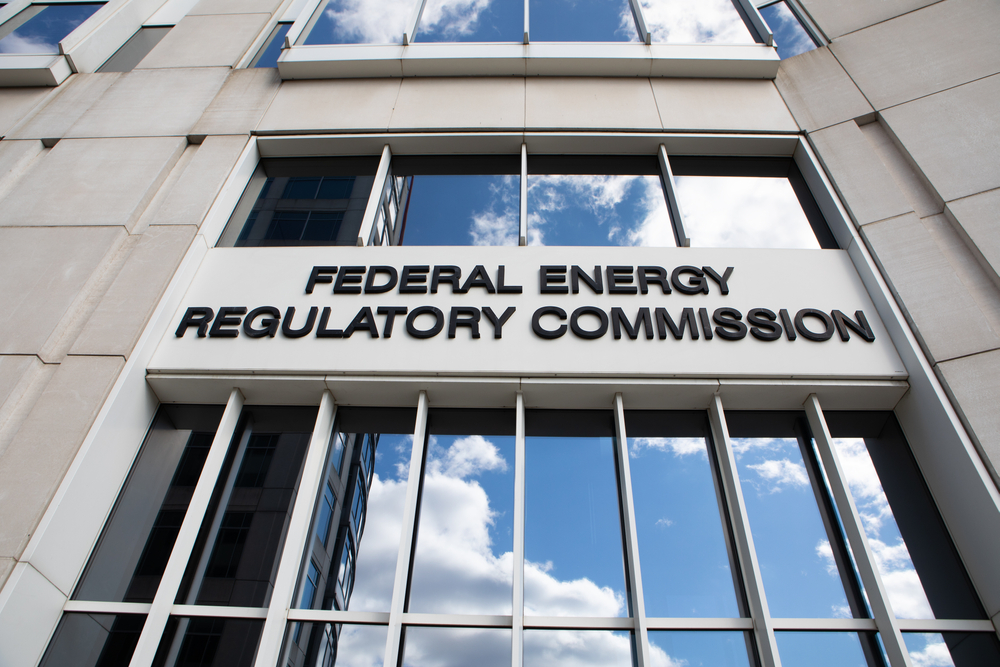

To understand what preoccupies the electric power industry right now — and how much distributed energy plays into it — look no further than a proceeding before federal regulators about interconnecting data centers and other large energy customers to the transmission system.

The Federal Energy Regulatory Commission’s Docket (FERC) RM26-4-000 has attracted hundreds of filings from players ranging from grid operators, power marketers, and big data center operators like Amazon, Google and Meta to state consumer advocates and tribal organizations.

But most striking is the participation of distributed energy companies in the docket. Their presence underscores a broadening of the industry’s purpose.

Traditionally built to provide resilience or cost savings for their host customers, distributed energy is increasingly demonstrating its value in easing pressure on an oversubscribed transmission system.

Enchanted Rock, Voltus, Sparkfund, Bloom Energy, FuelCell Energy, CPower, Enel North America, Tesla, and Mainspring Energy are among those making the case for distributed energy in the federal docket, along with supportive organizations, such as the Pew Charitable Trusts.

The proceeding isn’t about distributed energy per se. It centers on a jurisdictional issue arising because of the data center boom. Typically, states oversee retail customer connections to the grid. But the Department of Energy, which wants to speed the interconnection process, argues that it’s in the public interest for data centers and other large customers to fall under federal purview.

Goldman Sachs sees distributed energy playing an inevitable role serving the AI buildup, providing up to 25 GW — one-quarter to one-third of the power AI will need globally — over the next five years.

For distributed energy companies, the proceeding offers an opportunity to demonstrate that they can deliver the speed the AI race seems to demand, given that onsite energy and virtual power plants are quicker to build than centralized power plants and transmission lines.

Here’s what they had to say.

Massive category of untapped capacity

Unlocking distributed energy to wholesale markets will create a “massive category of untapped capacity to solve the growing pressure on the transmission system,” Tesla told federal regulators. The electric vehicle and battery manufacturer has installed about one million distributed batteries, of which a quarter participate in grid services programs.

Virtual power plants (VPPs) can be up and running in weeks and months, unlike the years-long construction timelines of conventional generation. But regulatory roadblocks keep them from unleashing their full potential, despite an earlier order (FERC 2222) that allowed them to participate in wholesale markets, Tesla said. The barriers center on metering and telemetry, device-size thresholds, and a lack of pathways for distributed energy to receive retail-rate credits.

Subscribe to the free Energy Changemakers Newsletter

Enchanted Rock, which has 1.5 GW of distributed energy in operation or development, promoted the idea of pairing new on-site, dispatchable generation with data centers to improve speed to power, reduce grid strain, and provide a flexible resource that grid operators can leverage during periods of peak demand.

The Texas-based microgrid developer described the growing practice of building onsite generation to serve a facility while it waits to connect to the grid. Once the facility connects, the onsite generation can act as a flexible grid asset, reducing demand or exporting power to the grid during peak periods. Given these benefits, such facilities should be granted expedited interconnection, Enchanted Rock argued.

DERs aggregated become as big as power plants

Voltus, Sparkfund and Cloverleaf Infrastructure also filed comments, together advocating for distributed capacity. (See our latest podcast interview with Voltus, Data Centers: Bring Your Own Capacity Instead of Building Power Plants.)

The companies said distributed capacity includes batteries, distributed energy, demand response, and grid-enhancing technologies, which are “readily installable en masse, and may be aggregated into utility-scale assets.” They cited several examples where this is already happening:

- The Southwest Power Pool added 431 MW of demand response — the equivalent of a large power plant — in 2023 and could incorporate the equivalent of another 500 MW power plant with just 200 batteries

- Arizona Public Service’s Cool Rewards thermostat program added 40 MW of capacity annually in recent years

- Ontario’s household flexibility program incorporated 90 MW in just six months

The three companies also pointed to a recent Rewiring America report that “hyperscalers could more than meet their total planned capacity needs by paying for battery storage as well as rooftop solar for homes well suited for it.”

Meanwhile, Rewiring America told FERC: “Many utilities, and DOE itself, have recognized that virtual power plants, which aggregate and control a network of distributed assets, have rapidly become among the lowest-cost pathways to new megawatts for the grid.”

Value of energy parks

Bloom Energy explained the value of energy parks, which interconnect new generation and co-located load as a single facility, with controllers to limit energy supply in and out of the facility. Use of energy parks “can lower transmission impacts and interconnection time without sacrificing reliability and indeed, improving it through accelerated integration of new supply,” according to the fuel cell manufacturer, which provides 400 MW to data centers.

CPower, Enel North America and again Voltus promoted demand response in a joint filing, while The Pew Charitable Trust pushed virtual power plants.

“DOE analysis finds that VPPs are already delivering tens of gigawatts of flexible capacity across the United States, and that with appropriate market access, they could serve 10–20 percent of national peak demand by 2030,” wrote Pew. “ Importantly, according to The Brattle Group, VPPs can be deployed on timelines shorter than traditional resources and at significantly lower cost, saving utilities tens of billions of dollars in capacity investments. VPPs are inherently modular and flexible, allowing them to scale rapidly, respond dynamically to system conditions, and provide verifiable reductions to a load’s net peak demand.”

Data Center company Equinix proposed that FERC allow data centers to leverage aggregated resources and demand flexibility.

In FERC’s court

The value of distributed energy for its customers — resilience, cost savings, cleaner air — has been clear for a long time. What’s apparent now is that the data center buildup offers an opportunity for the worth of distributed energy to be equally on display as a grid asset.

Goldman Sachs sees distributed energy playing an inevitable role serving the AI buildup, providing up to 25 GW — one-quarter to one-third of the power AI will need globally — over the next five years.

In the US, the industry is making its case. It remains to be seen how much FERC will focus on distributed energy when it issues a decision in the docket, expected in the spring.