It’s been a tough couple of weeks for centralized electric grids.

The American Society of Civil Engineers gave US energy infrastructure a near-failing grade in its annual scorecard.

In addition, Europe’s busiest airport, Heathrow, suffered a power outage on March 21 that stranded hundreds of thousands of travelers, leading to questions about the age, condition and constraints of the UK grid.

Meanwhile, it appears manufacturers may be increasingly turning away from grid power. The Energy Information Administration reported that US manufacturers’ use of renewable onsite energy grew 125% from 2018 to 2022.

So what’s going on? Not one problem, but several led the ASCE to give the US grid a D+ in its 2025 Report Card for America’s Infrastructure, down from C- in the organization’s last report four years ago.

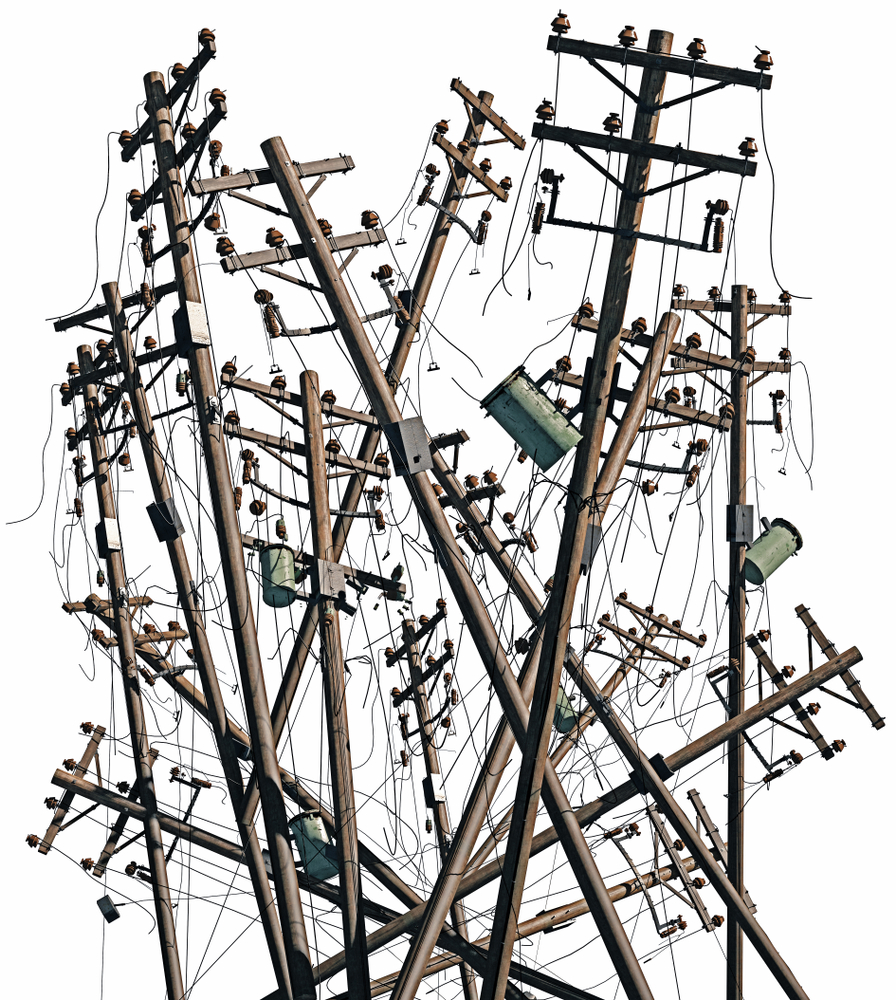

Credit: ASCE

Trouble with wires, poles, transformers

In the US, much of the problem rests with the utility distribution system, which includes 5.5 million miles of local distribution lines, over 180 million power poles, and 60 million distribution transformers.

The distribution system is not built for contemporary life.

It’s not standing up well enough to storms, severe heat, wind, snow, ice, and other destructive weather, which has caused 80% of US power outages since 2000. According to ASCE, 92% of the time, the problem stems from something damaged or gone wrong on the distribution system. Trees fall and bring down wires and poles.

US utilities have increased their spending on the distribution grid—from $44.5 billion in 2022 to $50.9 billion in 2023. But money isn’t the only problem. ASCE cites a shortage of distribution transformers caused by supply chain bottlenecks and a lack of domestic manufacturers. Procuring distribution transformers in the US can take 80 to 210 weeks, up from 50 weeks in 2021.

Busier electric grid

Meanwhile, the distribution grid is becoming busier. This is where the growing number of grid-edge technologies, such as electric vehicles and distributed generators, plug into the system. The ASCE forecasts that the US must increase distribution transformer capacity by 160% to 250% to meet grid needs by 2050.

“Transformer installation delays will slow down implementation of new energy projects and put the grid at risk if in-place transformers fail,” says the report.

Old-school poles represent another problem. The ASCE states that utilities frequently use poles rebuilt to outdated standards because “building codes do not require providers to replace fallen poles with stronger poles that are less likely to fail.”

ASCE recommends several solutions, the first of which is the creation of federal policy for “meeting current and future technology change, carbon reduction, renewable and distributed generation, state and market-based factors and rate affordability.”

What happened at Heathrow?

Across the pond, debate is underway about what could have averted the high-profile Heathrow power outage, which emanated from a substation fire and disrupted power for more than 60,000 nearby homes. The National Energy System Operator is investigating the outage, and a report is expected in about six weeks, according to the BBC.

The US experienced a similar high-profile airport outage in 2017 when the Hartsfield-Jackson Atlanta International Airport, the world’s busiest airport, lost power for 11 hours. The New York Times recently reported about distributed energy and redundant feeds that have been installed in several US airports since then to ensure reliable energy.

Inroad for onsite power

As for what’s driving manufacturers to on-site power, the EIA reported only numbers not reasons. But no doubt, the grid problems described by ASCE come into play.

Gareth Evans, CEO and co-founder of Veckta, which offers an onsite energy deployment platform, says in an upcoming Energy Changemakers podcast that price has been the top reason power customers seek distributed energy. But a shift is beginning to occur; poor power quality and power outages are rising in importance.

“We’re seeing more power quality issues. If your utility bill is $1,000, add 7%, and that is the cost of you having to replace equipment as a result of power quality issues,” Evans says. “Power outages are devastating for businesses. They lose production, they lose equipment. So I think while resilience is number two today, I think very quickly it will become number one.”

A move toward more onsite energy is also quickly emerging in the data center arena, one of the fastest-growing centers of new power demand. As tech journalist Rich Miller pointed out in a February 6, 2025 Energy Changemaker’s podcast:

“In the past data centers were never very eager to get into the energy business themselves. That has completely changed over the last 18 months. Almost all of the large data center operators are working on onsite energy options,” Miller says.

So as the central grid falters from C-level performance four years ago to D-level now, new doors open for distributed energy technologies.

Subscribe to the free Energy Changemakers Newsletter