As homes grow smarter and more electrified, the home energy management system (HEMS) has emerged as a way to give homeowners control over their energy usage. Once a luxury feature, smart home tech is becoming mainstream.

Now businesses from a range of industries are trying to capture the HEMs market. What does it take to win, and what exactly is the prize?

According to Fortune Business Insights, the global smart home market was valued at $101.07 billion in 2023 and is projected to grow to $633.20 billion by 2032. While HEMS will only be a subset of this, driven by battery and EV adoption, the size of the market is still significant.

But owning the HEMS customer offers more than just a new revenue stream; it gives companies a place in homes across the country. This translates to increased customer loyalty, brand recognition, and the potential to expand into the utility space through demand response and virtual power plant programs.

Subscribe to the free Energy Changemakers Newsletter

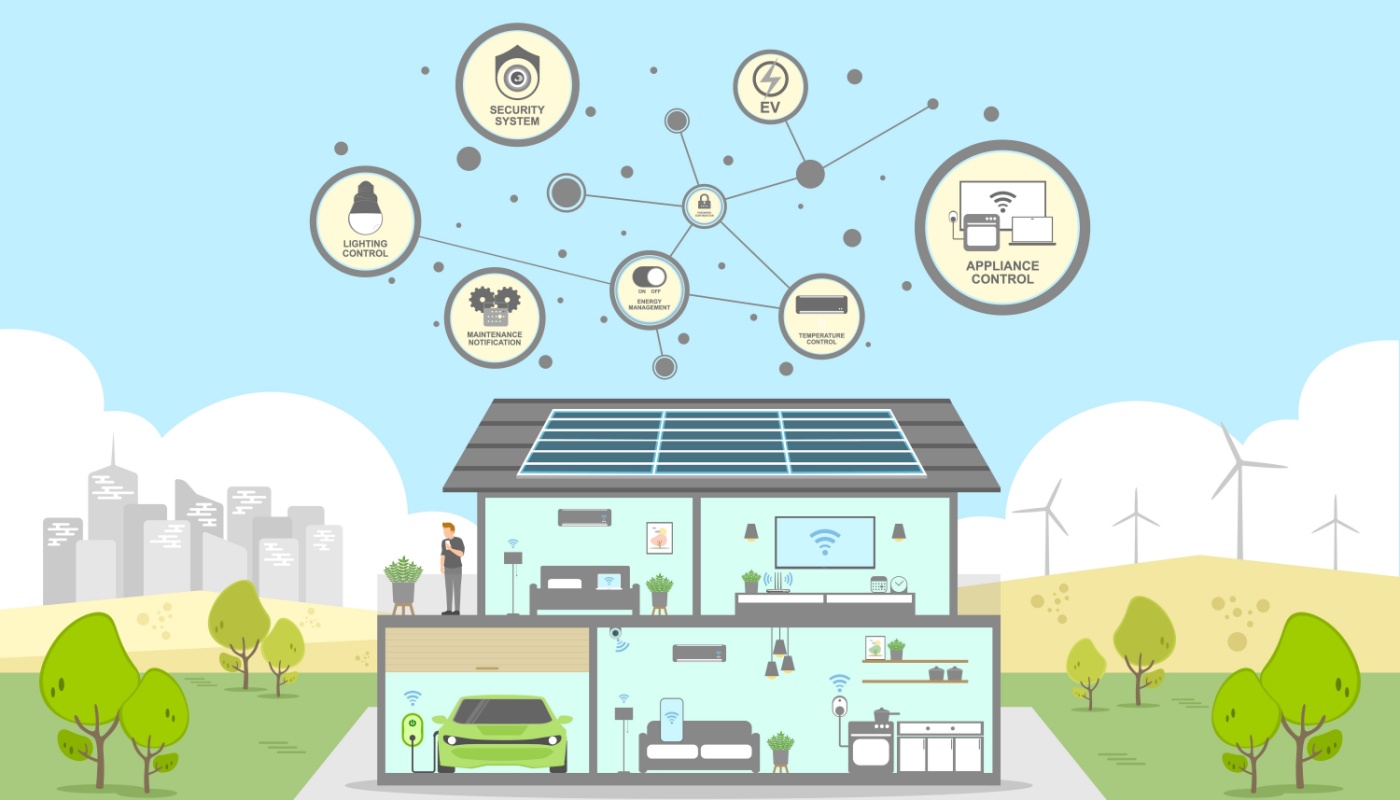

For consumers, home energy management systems can provide energy insights, schedule energy use for optimal cost savings, improve efficiency, expand resiliency, and help avoid costly service upgrades when they add electric vehicles or other services. Smart thermostats, like Nest and Ecobee, already optimize heating and cooling. HEMS represents the next step, integrating and managing distributed energy resources (DERs) to control the flow of energy between devices, the home, and the grid.

With more than 150 million homes in the US, many companies from diverse industries — vehicle OEMs and electrical panel companies to battery storage and smart home tech giants — are vying to lead in the HEMS space. What do they need to deliver to be serious contenders?

The competencies to compete

Capturing market share requires the right business structure and product capabilities. Contenders need software expertise and resources to integrate with a broad range of DERs, deliver a seamless user experience, and inevitably integrate AI-driven optimization for efficiency and revenue potential. HEMS providers must manage everything from heating, ventilation and cooling systems to electric vehicle charging to storage.

Success necessitates strong partnerships, software integrations with multiple vendors, and ongoing customer support. This requires both software technical expertise and an organizational structure conducive to ongoing collaboration. The user experience is another key component to gaining customer adoption and engagement. Companies that can deliver intuitive, engaging user experiences are well-positioned to build customer loyalty.

The contenders

The competition for HEMS dominance is just beginning as various industries enter the space. Each has unique strengths and weaknesses:

- Vehicle original equipment manufacturers: Auto manufacturers are eyeing HEMS as a potential extension of their core offerings, as EVs often represent the single largest energy load in a household. One challenge for automakers is their lack of direct channel to the residential market due to their dealership model. However, they enjoy brand loyalty as consumers are already attached to familiar names like Ford or Toyota. This could help them capture HEMS market share if they can innovate fast enough. Another challenge is that automakers’ strength is in hardware rather than software. To compete with the likes of Tesla in the EV and HEMS space, they have to build software expertise and structure development and product releases in a way that supports ongoing software integrations and updates. Traditional automakers are going to find this transition difficult both from an organizational and a technology integration perspective.

- Electrical panel manufacturers: Electrical panel companies hold a strategic advantage as they’re uniquely positioned at the heart of home energy systems with their products controlling the flow of electricity to every load in the home. With the advent of smart circuit breakers and energy monitoring devices, they are reimagining the electrical panel as the home’s energy control hub. These companies have a strong channel into homes through electricians but lack brand recognition with the consumer. They, too, need to evolve from a hardware-centric model to a software-integrated model. However, they know power and energy well, and maybe most importantly, they understand how these systems need to integrate and what regulations govern them.

- Battery storage companies: Battery storage companies arguably brought the need for HEMs to the smart home space. They are uniquely educated in selling homeowners systems that provide resiliency and energy management. They understand the energy management ecosystem and are skilled at integrating with third-party products such as solar and EV chargers (yes, even Tesla). While these companies understand storage and energy management well, they may lack the necessary control over all home loads. Most tend to have strong software capabilities and have incorporated features for participation into utility demand response and virtual power plant programs. Success for battery companies may well depend on their channel to market, which varies greatly between smaller start-ups and established legacy companies.

- Smart home companies: Tech giants in the smart home space, such as Amazon and Google, have extensive expertise in user-friendly software and Internet of Things (IoT) ecosystems. They are software companies at their core making them natural contenders in HEMS. The companies in this space have strong customer relationships and an ecosystem designed to integrate with third-party devices. Yet, these smart home companies are relatively new to the energy space and face a steep learning curve when it comes to the electrical industry and the regulations that govern it.

Whether automakers, panel makers, battery providers, or tech giants ultimately lead the HEMS market remains to be seen. What’s clear is that the winner will hold a powerful position in the future of energy management, offering consumers more personalized, resilient, and flexible energy solutions. As the market evolves, the companies that can deliver seamless integration, intuitive customer experience, and scalable, grid-ready solutions are poised to become leaders in the HEMS space, redefining the future of home energy and grid interaction.

Anna Demeo, managing partner at Climate Tech Strategy Advisors, acts as a strategic and technical advisor for companies and investors across the cleantech sector.