Building electric vehicle chargers in the US is a tough business.

“In the last year, several charging companies have either gone bankrupt, had a significant number of layoffs, or pulled out of the US market,” said Loren McDonald, Chief Evangelist of Paren, an EV data company.

On top of that, competition is getting stiffer, with corporate and international entrants pushing into the market, including Mercedes-Benz, Walmart, and IONNA (a consortium of eight major automotive companies.) Competition among hardware companies is also on the rise, with entrants from Europe, China, and South Korea, he said.

Meanwhile, according to engineering testing company Averna, the US ranks behind Norway, the Netherlands, China, Germany, the United Kingdom, and Sweden in the build-out of electric vehicle chargers.

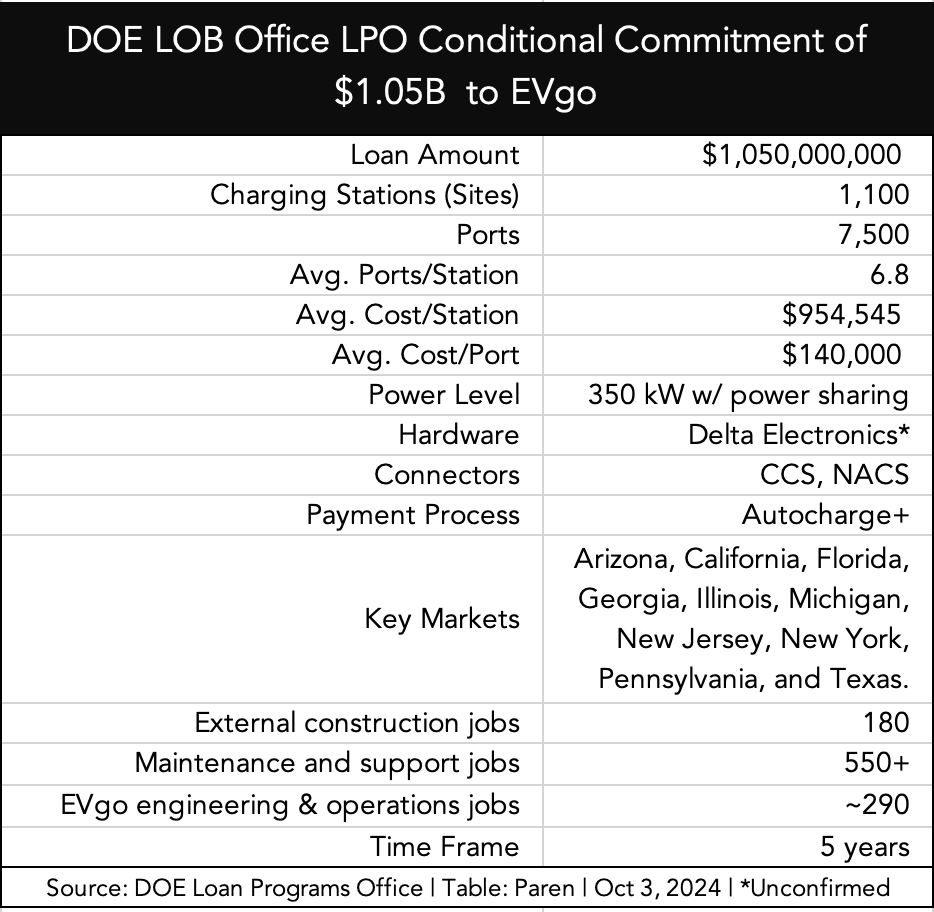

So yesterday’s announcement of a $1.05 billion federally backed loan guarantee to EVgo “is a big deal from the perspective of the additional financial stability it brings to the build-out of fast charging infrastructure in the US,” McDonald said.

Track news about electric vehicle charging and other distributed energy resources. Subscribe to the free Energy Changemakers Newsletter.

The California EV charging company intends to build 7,500 public fast-charging stations across the US by 2030 using the conditional debt financing from the Department of Energy’s (DOE) Loan Program Office (LPO). This will add to EVgo’s 1,000 fast-charging locations in 35 states.

Arizona, California, Florida, Georgia, Illinois, Michigan, New Jersey, New York, Pennsylvania and Texas are expected to be the biggest winners from the loan guarantee, especially in marginalized areas, which are slated for 40% of stalls, as specified by the Biden administration’s Justice40 Initiative.

Built at grocery stores and other high-traffic areas, the charging stalls will have 350-KW chargers that serve two cars at once. The chargers will feature what the DOE calls dynamic power sharing, which optimizes power output among vehicles charging at a station.

US still lags on public electric vehicle chargers

The funding is in keeping with the Biden administration’s goal to build 500,000 publicly available EV chargers by 2030, which it says is on track. To move it along, the federal government is dispursing $7.5 billion for EV charging from the Bipartisan Infrastructure Act.

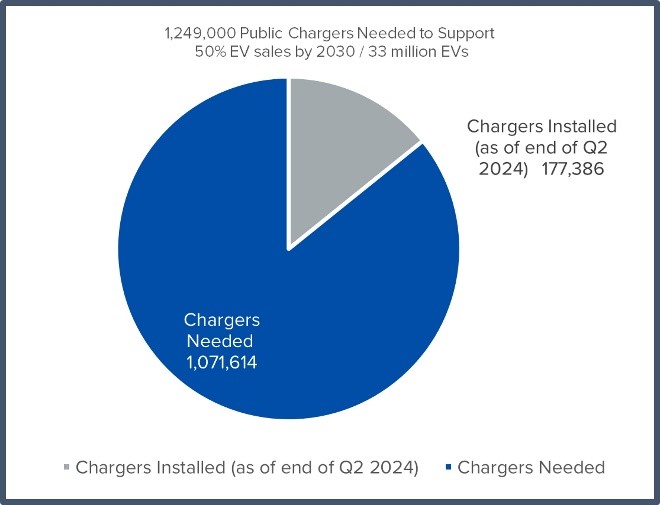

However, according to this week’s report by the Alliance for Automotive Innovation, the US may still have trouble providing enough public charging to meet EV demand. The trade and data organization says the nation is not on track to meet a target set by the National Renewable Energy Laboratory. To adequately serve EV users, the research lab foresees the need for 1 million Level 2 charging ports at publicly accessible locations by 2030.

Credit: Alliance for Automotive Innovation

The good news is that EV sales are growing; the bad news is that EV charging installations are not keeping up. The Alliance for Automotive Innovation found that in the second quarter of 2024, the US added 8% more EVS to the road and 6% more public chargers.

EV sales grew even as gasoline and diesel car sales fell 3.83%. Specifically, EVs made up 9.96% of light-duty vehicle sales during the second quarter, up from 9.05% at the same time last year.

California continues to top the chart for the percentage of car registrations represented by EVs, at 26.7%, followed by Colorado (19.43%), the District of Columbia (19.35 %), Washington (17.87%), Oregon (15.97%), Nevada (15.4%), Hawaii (14.39 %), New Jersey (13.25%), Vermont (11.93%), and Massachusetts (11.57%).

The report finds that to keep up with EV growth, 451 chargers will need to be installed daily – nearly 3 chargers every 10 minutes – through the end of 2030.

An expensive endeavor

Part of the problem is that building fast charging stations is expensive and can take several years (often 3-5 years) to break even, according to McDonald.

McDonald calculates that an EVgo station will cost, on average, nearly $1 million to build. So if EVgo builds about 220 sites each year, the project cost will be $200 million annually.

Credit: Loren McDonald, Paren

McDonald added that the DOE loan puts EVgo in a good financial position, easing pressure to raise capital or seek multiple smaller loans over the next few years.

Although it announced layoffs last year and earlier this year, McDonald said EVgo is on pace to be profitable in 2025. (Yesterday’s DOE announcement gave EVgo’s shares a boost.)

Also notable is that EVgo’s average utilization roughly doubled in a little more than a year, according to McDonald. “Part of this is due to growth in EV sales, but much of it has been driven by an explosion in rideshare drivers from Uber and Lyft increasingly adopting EVs.”

The DOE loan will be structured as limited recourse project financing, according to EVgo. The Federal Financing Bank will provide the loan, with the DOE guaranteeing it. The company won’t need to raise third-party equity — public or private — to close on the financing. However, the loan is conditional, meaning EVgo must meet technical, legal, environmental, and financial conditions before the DOE finalizes the award.

“EVgo shares the Biden-Harris administration’s goal of increasing EV charging access in the communities that need it most,” said Badar Khan, CEO at EVgo. “This historic investment would meaningfully accelerate our network expansion to provide public charging to EV drivers across the United States.”