Jenny Shalant, editorial director at the Natural Resources Defense Council, provides an explainer on what’s causing electricity rates to rise and how to keep them in check. This article originally appeared on NRDC’s website.

Another month, another utility bill. And the amount due is a shocker every time.

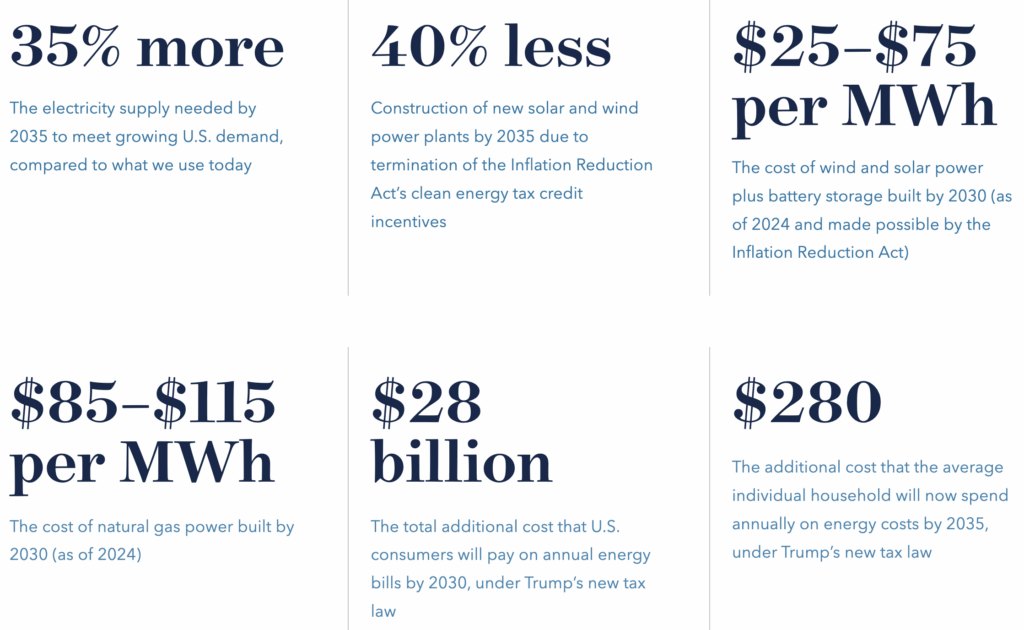

Nationwide, households have watched their electricity prices rise 13 percent on average between 2022 and 2025, according to the U.S. Energy Information Administration. Now, thanks to the tax bill that President Trump signed into law on July 4, we can expect to pay even more.

What’s behind those big numbers? It’s not just inflation; in certain areas of the country, electricity rates have considerably outpaced that figure. And our own personal habits and circumstances are only part of the story.

Yes, worsening summer heat waves have led to more AC use and our increasing digital diets have also put new strains on our power supplies. But the bigger, longer-term explanations have to do with our aging grid, the rising costs of fossil fuel production, and the active choices made by some elected officials and others in power to keep us tethered to those costly, climate-damaging energy sources.

Our aging power plants

A quick history lesson: After World War II, the U.S. power industry was busy. The economy was growing and industrialization was revving up. The population ballooned and so did what’s known as “load growth,” or electricity demand. “Everybody bought a washer and dryer, an air conditioner, a washing machine, and a dishwasher,” says Jackson Morris, director of state power policy at NRDC. “There was a giant period of building,” which included lots of coal and gas power plants.

Fast forward to today, and those midcentury-era power plants have grown old. And just like with the transmission of a car, all the components of a fossil plant—a coal boiler, a gas turbine—can break or wear down. Meanwhile, various technological innovations have rendered many of those old parts inefficient or obsolete. Not surprisingly, coal generation has been plummeting for about 15 years.

For owners of aging plants, Morris says, “eventually, it doesn’t make any economic sense to keep pouring money into maintaining them.”

Nearly half of the country’s coal-fired power plants have already retired due to being too expensive to run, and building new plants is costly as well. Fossil fuel energy sources are also subject to volatile price swings, as we’ve seen with natural gas in recent years. Increasing bouts of extreme weather (a consequence of climate change) are partly to blame, and drilling for more oil and gas can’t offset the rising costs of these global commodities.

Renewables to the rescue—if we let them

The good news is that renewables have been the biggest—and cheapest—sources of new power on the U.S. grid. Effectively, wind and solar energy have been helping to lower electricity prices by reducing the need for more expensive and inefficient sources of generation like coal. And this helps explain why some of the states with the most wind and solar generation (like areas of the Great Plains) have seen retail electricity rates lag behind inflation.

Nevertheless, for years, electric utilities and regulators have faced a dilemma: Make investments in cheaper, cleaner power and dole out incremental rate hikes to help pay for the new projects, or kick the can down the road to prevent the immediate fallout with consumers or the politically powerful fossil fuel industry.

Subscribe to the free Energy Changemakers Newsletter

The Inflation Reduction Act (IRA) of 2022 was helping utilities modernize their businesses through its tax incentives that encouraged more renewable power generation and the building of transmission lines to get that cheaper, more sustainable electricity online. The IRA also brought various clean energy economy investments into places that needed the most help—like rural America.

But all that progress is grinding to a halt under the Trump administration’s reconciliation law. Along with efforts to thwart wind and solar projects and discontinue tax credits that help homeowners make energy efficiency improvements, the federal government is opening up more lands and coastal waters to oil and gas drilling, keeping inefficient coal-fired power plants running past their retirement dates and advancing very expensive nuclear power projects.

To get a sense of what’s to come for our electricity bills when we opt for pricier energy sources, consider a case study from Georgia. There, one of the biggest drivers of rate increases has been Georgia Power’s decision to build a massive nuclear plant. Many renewables advocates have long eschewed nuclear power, despite its low-carbon value, due to its significant safety, global security, environmental, and economic risks. The state’s Plant Vogtle bore out those financial concerns: Originally expected to cost $14 billion, the facility, which began operating in 2023 (a full seven years behind schedule), ultimately cost $35 billion.

“And they send that right onto the utility bill if you’re a Georgia Power customer,” Morris says. According to a 2024 report by an environmental coalition, the result was a 24 percent rate increase for consumers.

Other grid operators have let renewable projects sit idly in their queue, losing out on opportunities to boost their energy supplies in sustainable and cost-effective ways. That’s the case for PJM, which serves around 67 million people across 13 states, from the tip of North Carolina up through Michigan. The utility’s delays in connecting its grid to some 286 gigawatts from new solar, storage, and wind projects (enough to power 45 million homes) have handcuffed PJM to its aging fossil fuel–fired plants. This resulted in prices careening upward by a shocking 600 percent. The new fees kicked into consumer bills just last month, with some residents now paying up to $360 more per year. And this trend persists for PJM customers. As of late July, their electric prices went up yet again.

The price of an AI boom bent on fossil fuels

Adding urgency to our power supply predicament, a new period of massive load growth has begun—one that rivals that of the mid-20th century. Enter AI and the data center boom.

Whether it’s AI or cryptocurrency, these relatively new digital products demand massive amounts of electricity. And though the enormous data centers that support them have only been running for about two years now, experts predict they could eat up an estimated 5 to 9 percent of U.S. electricity generation annually by 2030.

“Absent guardrails, there is the potential for data centers to be responsible for massive increases on utility bills for everybody,” says Morris, who is coauthoring a forthcoming report on policy guidelines for the AI sector’s responsible development. Morris emphasizes that utility regulators can and should make sure that AI companies pay their fair share of the costs for this demand.

And fueling this boom with fossil fuels would carry a steep price as well. NRDC’s Mohit Chhabra, a senior analyst of regulatory and economic policy, says, “Not only does making renewables more expensive and propping up inefficient power plants result in unnecessary increases in pollution, but it also results in a giant wealth transfer from electricity consumers to all private power producers.”

The wholesale price of electricity at any moment is set by the most expensive power plant operating. So when an inefficient plant that would otherwise have been retired—and replaced by renewables—keeps its turbines spinning, it raises electricity prices for the whole market. For the fossil fuel industry, it’s a winning proposition.

“It results in higher earnings, not just for that inefficient plant, but for every private power producer operating at that time,” Chabra says. “These excess earnings are made on the backs of American households and businesses.”

Consumers lose in three ways: We pay more to prop up an inefficient power plant; we pay more for the electricity we consume; and we breathe dirtier air.

Making new gas or nuclear plants fill the electric demand gap isn’t the answer either. A recent analysis by NextEra Energy, one of the country’s largest electric and gas utilities, looked at the costs and timeline of building this infrastructure today. The company projects that the price of a new gas plant is going to increase by three3-fold between 2021 and 2030. The report also expects gas plants to need more than five years to get built and running (and 10 years for nuclear).

In contrast, NextEra notes, “renewables and storage are the most cost-effective energy and capacity solutions, and are ready now.” Wind and sunshine, after all, are free and abundant. And the capital costs to build the infrastructure to harness these resources are competitive with fossil fuel infrastructure.

So with fossil fuels, we’re betting on the wrong horse.

Prepare for higher electricity bills—but also fight back

With the federal government phasing down incentives for solar and wind power through 2027, we’ll need to start budgeting accordingly. Researchers from Princeton University’s ZERO Lab recently found that the IRA’s repeal would drive electricity bills higher for years to come. Based on Trump’s tax law and the ongoing rollbacks of environmental standards at the EPA and other agencies, by 2035, families nationwide can expect to pay up to $430 a year more on energy costs.

The reconciliation law, aka the Trump energy tax, will only add to the squeeze we all feel these days. “A lot of Americans are struggling with just the cost of living,” says Amanda Levin, director of policy analysis in NRDC’s Science Office. “It isn’t just electricity bills. It’s the cost of groceries, of day care, of housing. But increasing the price of energy bills just adds further pressure on a growing number of low- and moderate-income households that already can’t afford the basic necessities.”

It’s a bleak picture, but giving up is not an option. The country needs to modernize its electric system, to make it resilient to increasingly routine extreme weather events. Climate-fueled disasters are directly impacting our grid in every region, from the wildfires threatening infrastructure in California to the winter storms causing fossil plant machinery to freeze up and shut down in places from Buffalo all the way down to Houston. And upgrades cannot come at the cost of reliable electricity for all.

This is why advocates are urging utilities and state leaders to seek more creative and equity-minded ways to manage costs over time for consumers. For example, income-based fixed charges can help ensure that what people pay reflects their financial circumstances. NRDC has been pushing for these programs for many years, including during the peak of the COVID-19 pandemic when it partnered with local groups in Los Angeles to push the city’s department of water and power to relieve utility debts of low-income customers and prevent electricity shutoffs for those who couldn’t pay.

Customers can also speak out against rate hikes at public hearings. When a public utility commission is proposing large rate increases or considering its next major investment, it will hold comment periods (in person and/or through online forums) every day of a hearing. People can push for low-income bill assistance, energy efficiency program enhancements, and other consumer protections. After all, says Levin, “energy affordability is a metric that a utility is judged on.” In other words, protecting ratepayers is in a company’s best interest too.