The US Senate Finance Committee released its version of President Trump’s “Big Beautiful Bill” Monday, which goes easier on clean energy than the version passed by the House in May — but not by a lot.

Residential solar, energy efficiency and electric vehicles tax credits are hit hard; energy storage, hydroelectricity and geothermal do better. The budget reconciliation bill also preserves “transferability,” which allows companies to sell their clean energy tax credits.

The bill, which reverses several key clean energy provisions of the Inflation Reduction Act (IRA), requires 51 votes in the Senate before going back to the House for a vote. Republicans hope to pass the bill by July 4, but several points of contention remain to be worked out with the House. The IRA is only one element of the bill generating controversy. The bill makes cuts to Medicaid and science funding, changes certain tax deductions, and extends income tax cuts.

“Republicans currently have a simple majority in the Senate with 53 seats, so each vote matters. Four GOP Senators have previously voiced their concerns about rolling back energy tax credits, and others have expressed more nuanced comments on the House bill. Senate Republicans are internally discussing the legislation to determine whether it has sufficient votes to pass as-is or if additional changes are needed,” writes the Clean Energy Business Network (CEBN) in a detailed note that compares the House and Senate versions of the bill.

A poll by the Pew Research Center finds that more Americans oppose the bill than support it: 54% said it will have a mostly negative affect on the country, with 30% holding the oppositve view and the remainder saying it will have little effect.

On clean energy tax credits, in particular, half of those surveyed opposed ending the tax credits, while another 29% favor it, and 21% are not sure.

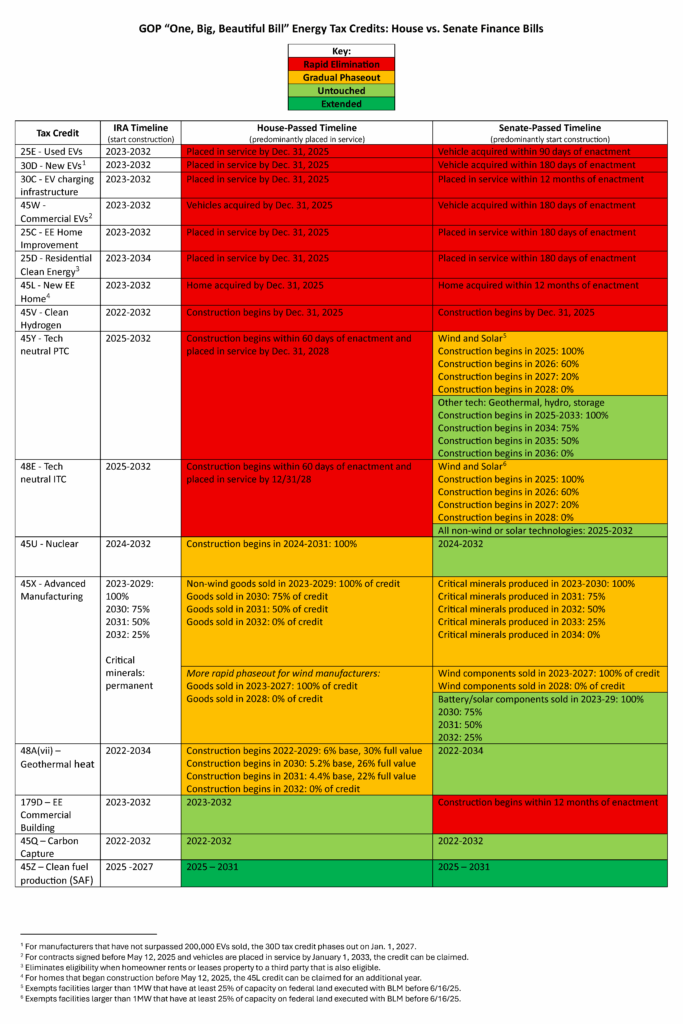

Here is a concise chart created by CEBN that lays out the proposed changes for clean energy.

If you’re feeling ambitious, here is the full bill as it now stands.