The falling costs of three key technologies deployed in global energy markets over the past few decades — solar photovoltaics (PV), battery energy storage, and wind turbines — have catalyzed global clean energy investment from the private sector.

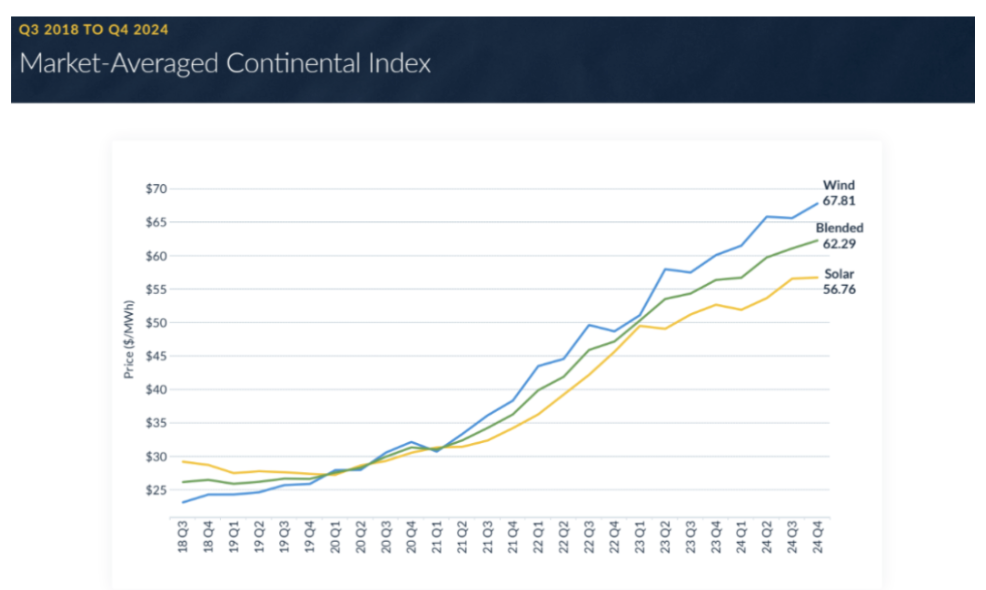

Whereas these component costs have, until very recently, been steadily dropping, power purchase agreement (PPA) prices from independent power producers (IPPs) for new clean energy projects have been steadily increasing since 2021, according to the LevelTenEnergy tracking database (see chart below). Why is this so?

Increases in IPP PPA prices for solar (and wind) may be surprising given the steady decline in costs associated with PV modules in the last three decades, as demonstrated in the chart below. With each doubling of installed capacity, solar PV module costs have historically dropped by 20%.

Solar PV Module Cost Trends: 1975-2023

Source: Our World in Data

The diverging trends between component costs and PPA market prices are exacerbated by uncertainty thanks to federal energy and trade policy shifts. The same report that included the chart above noted a 90% drop in battery energy storage and a 70% drop in wind power costs over the past decade, if calculated based on a levelized cost of energy (LCOE).

Factors Leading to Clean Energy Project Price Increases

While COVID-19 is no longer making major headlines, its impact on supply chains is one reason why PPA prices started rising in 2021. Competition for production slots delayed equipment deliveries for at least a year, and the laws of supply and demand are jacking up prices from 10 to 30%, according to one industry veteran involved with microgrid developments for over 25 years. A risk premium is charged since PPA prices try to factor in where prices will go and anticipate market prices when these assets go operational. He predicted that demand growth hype will subside in about a year, and it will take another year before the supply chain can catch up, at which point PPA prices will decline again. It’s not only clean energy technologies witnessing price increases; it also applies to turbines fueled by natural gas and other electrical equipment.

“It’s a bit of legalized looting,” he said, noting that greed probably is playing a role in upward pricing trends.

Others note that all energy prices are rising, so PPAs are rising in lockstep. Resident electricity rates across the entire U.S. have increased by 30% since 2021, according to an analysis released this year.

The simple laws of supply and demand are clearly playing a role in price increases, as are dramatic public policy shifts. The proposed cancellations of government incentives, particularly the truncating of the availability of the federal investment tax credit (ITC) included in the Inflation Reduction Act (IRA) passed during the Biden Administration, have jeopardized more than $14 billion worth of clean energy project investment. (Some surmise PPA cost increases could even be linked to the IRA’s provisions to bolster local U.S. component content in projects funded partly by federal government incentives.) The stop-and-go Trump Administration tariff announcements and court decisions add uncertainty to financial markets, leading to increased volatility and corresponding risk. These upward price trends may not ease until 2030, claims Ascend Analytics.

Subscribe to the free Energy Changemakers Newsletter

U.S. solar module prices started inching upwards in late 2024, with an estimated 4% increase to $0.26/watt in December. According to Sunhub, the reciprocal tariffs have now been fully priced into wholesale module quotes. For example, Chinese module supplier SolarSpace raised its U.S. wholesale price in April by 35% to $0.297/watt. Battery energy storage costs are also expected to increase by a similar percentage, according to Clean Energy Associates.

What about wind power? A speculative report published by Statistica in late January 2025, projected that the Trump administration’s announced tariffs on Canada, China and Mexico would increase wind costs in the U.S. by 5 percent. The report authors note that 41% of wind-related equipment imports for the U.S. market come from Canada, China and Mexico. If court interventions halt the U.S tariffs, these projections would fall along the wayside.

Battery energy storage devices are most at risk in terms of price increases linked to tariffs, according to Wood Mackenzie and Anza Renewables

Alaska Specific Factors Leading to PPA Price Premiums

These public policy shifts and cost increases will impact many states. Among them is Alaska, which was grappling with confusing data as it considered a Renewable Portfolio Standard (RPS). The RPS failed in the recently concluded legislative session, but is sure to be resurrected in some form next year. The cold weather climate of Alaska and long transportation routes, as well as special installation requirements at remote sites all contribute to typically higher costs for Alaska clean energy projects than the rest of the country. For example, a recent wind turbine project consisting of two 100 kW turbines deployed in the US’ northernmost site provided electricity at about 25 cents/kWh.

Scale matters. Take solar photovoltaics. Once considered the most expensive power generation technology in the mid-80s, it is now often touted as the lowest-cost electricity resource if developed at a large scale. The largest solar PV farm in the world — the 5 GW Xinjiang solar farm — will deliver a much lower cost of electricity than the 8 or 10-kW system on anyone’s rooftop. The largest operating solar PV system in Alaska today is 8.5 MW.

Each of these technology categories is not monolithic. For example, due to logistical challenges, wind turbines have so far been limited to 3.4 MW a piece in Alaska due to installation and transportation challenges, though the majority of wind turbines deployed in the state are below 1 MW in size (with many in the 100 kW size range, as noted above.) This means Alaska will pay more for wind than many other locations. For example, the world’s largest wind turbine on the market today is 20 MW — which can render a lower electricity cost — but it is designed strictly for offshore wind applications.

Alaska also faces limitations when it comes to energy storage. Not all stationary batteries have been able to perform up to expectations or even survive in Alaska due to extreme cold weather conditions. The dominant battery energy storage technology in today’s power markets is lithium-ion batteries. Alaska pricing for battery energy storage systems generally carries a premium due to long-distance shipping, logistics and the need for special heating systems.

And even solar PV panels — which require the least amount of maintenance of any power-generating technology — require special installation techniques in some parts of rural Alaska, such as Kotzebue. (See photo.) In addition, bifacial solar PV panels are preferred in Alaska due to their ability to generate electricity from the reflection of sunlight from snow. Yet they, too, carry a cost premium. At the same, if combined with solar tracking technologies, they can boost production by as much as 27% over standard one-sided solar PV panels.

Administration Tariffs and U.S. Congress Hold the Keys

Golden Valley Electric Association (GVEA), a utility located on Alaska’s Railbelt grid, reports that prices for wind power and BESS systems have gone up since it issued solicitations, but the exact extent of those increases is not publicly available. GVEA has been counting on federal support — over $200 million — for a large BESS system (46 MW/92 MWh) and related transmission and distribution system upgrades for Fairbanks, as reported late last year.

A few key Republicans are protesting the IRA incentive cuts in the budget that passed the House of Representatives in May given the economic benefits these projects bring to many so-called “red” states — as well as specifically to Alaska — as was reported in the New York Times.

“A wholesale repeal, or the termination of certain individual credits, would create uncertainty, jeopardizing long-term project planning and job creation in the energy sector,” Senator Lisa Murkowski of Alaska wrote to the Senate majority leader along with three other GOP colleagues.

Solar projects planned for Alaska’s Railbelt have already been stalled or canceled due to uncertainty surrounding IRA incentives, the New York Times reported. The recent Senate Finance Committee version of the budget reconciliation bill reinstates some of the IRA incentives lost in the House version, but deployment dates were pushed up.

Alaska has traditionally been highly dependent upon federal grants and other forms of support. While an RPS could send the right market signal for the Railbelt grid to boost its renewable energy resource mix to match the innovation occurring in remote communities, the current chaos on trade policy coupled with surging demand for clean energy is making the argument on behalf of a sound sustainable energy strategy more difficult not only in Alaska, but throughout the U.S. China remains the key on the tariff front. The Senate will help determine the viability of many projects that were designed around IRA incentives, not only in Alaska but for dozens, if not hundreds of projects throughout the U.S.

Hanging in the balance are the U.S. economy and the world’s environment.

Peter Asmus is the president of Pathfinder Communications. He has served as senior advisor, microgrid strategy and thought leadership, for the Alaska Center for Energy and Power over the past two years.