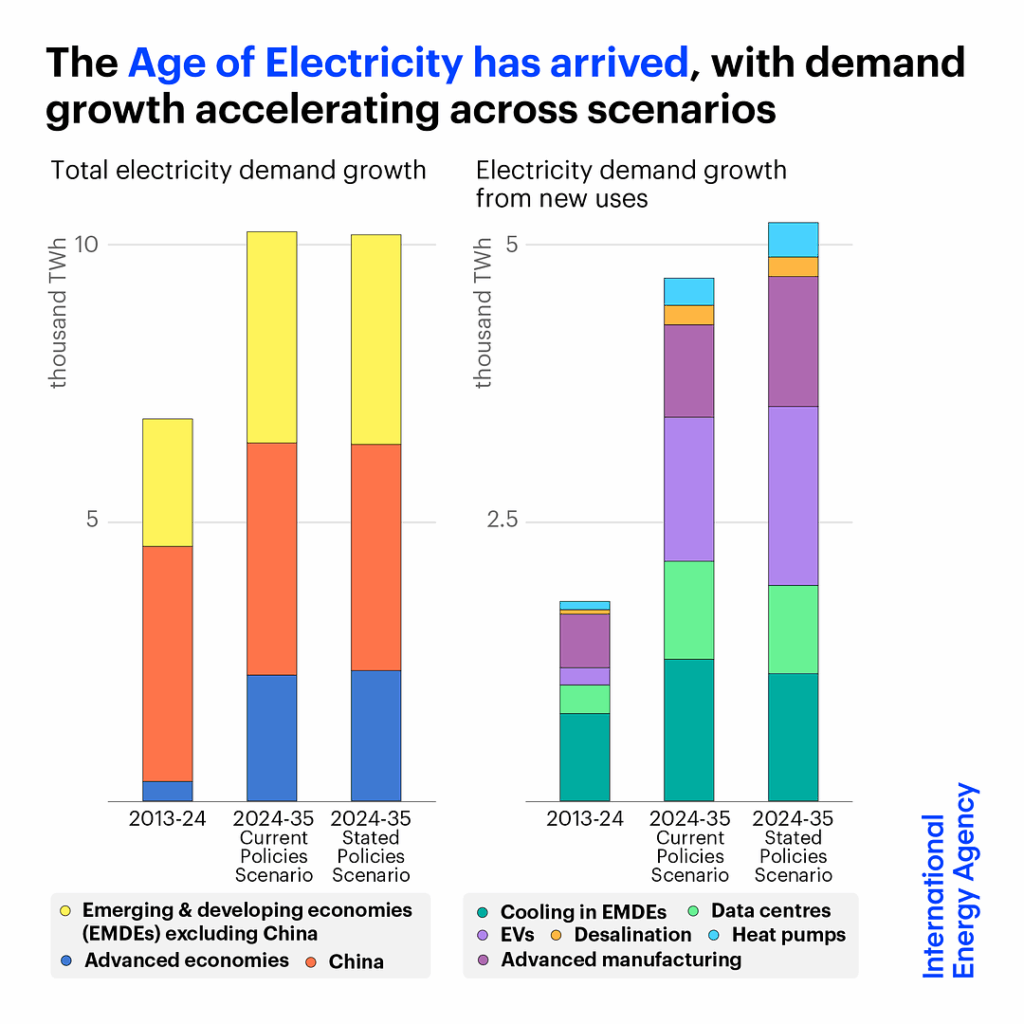

With last week’s release of its annual World Energy Outlook, the International Energy Agency proclaimed we’re now in the Age of Electricity.

Energy demand is growing, but electricity demand is growing even faster.

Investors are responding. Spending for electricity supply and end-use electrification already accounts for half of today’s global energy investment, according to the report.

And demand growth is no longer largely confined to places like Sub-Saharan Africa and parts of Asia.

“In a break from the trend of the past decade, the increase in electricity consumption is no longer limited to emerging and developing economies. Breakneck demand growth from data centres and AI is helping drive up electricity use in advanced economies, too,” said Fatih Birol, IEA executive director. “Global investment in data centers is expected to reach $580 billion in 2025. Those who say that ‘data is the new oil’ will note that this surpasses the $540 billion being spent on global oil supply – a striking example of the changing nature of modern economies.”

Minigrids in emerging economies

But when it comes to growth in decentralized energy, emerging economies remain where most of the action is. Around 730 million people still live without electricity, and 2 billion cook with unsafe fuels.

IEA outlines a plan to bring electricity to about 80 million people annually by 2035 by building grids, minigrids — which IEA defines as off-grid microgrids — and stand-alone systems such as solar and batteries.

By 2035, over 45% of new electric connections in these economies are expected to be from grid extensions; 30% from minigrids (mostly solar), and 25% from stand-alone systems.

IEA says it will cost USD $250 billion in investment between 2025 and 2035 to fund universal electrification. The figure includes capital expenditure, the cost of installing grid or minigrid lines, and equipment costs for decentralized solutions.

That’s $23 billion per year — a sevenfold increase in current spending on electricity access and “a sizeable portion of expected power sector investment outlays in the coming years,” the report says. Funding minigrids, in particular, requires access to cheap debt.